Accruals And Deferrals

A deferral of revenues or a revenue deferral entails money that was acquired prematurely of incomes it. An example is the insurance firm receiving cash in December for offering insurance coverage safety for the subsequent six months. Until the money is earned, the insurance coverage company should report the unearned quantity https://www.simple-accounting.org/ as a current legal responsibility corresponding to Unearned Insurance Coverage Premiums.

For accountants, recording accruals is a every day task that requires meticulous attention to element and a deep understanding of the enterprise’s operations. In summary, while both accrual and deferral accounting strategies purpose to track monetary transactions, they differ primarily in when income and expenses are acknowledged. Accrual accounting offers a extra accurate illustration of a company’s financial efficiency over a period, while deferral accounting may be simpler but can result in distortions in financial statements. The selection between the two methods is determined by components similar to regulatory requirements, enterprise measurement, and the necessity for accuracy in financial reporting. Accruals are changes made to recognize income or expenses that have been earned or incurred but haven’t but been recorded. For instance, if a company supplies companies in December but doesn’t receive payment until January, it might acknowledge the income in December via an accrual.

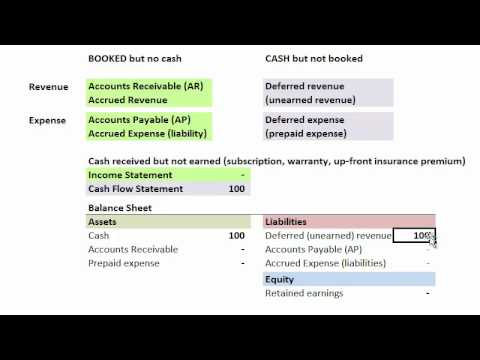

The difference between income accruals and deferrals are summarized in the table under. When studying about GAAP, it’s essential to know the impact of IFRS on financial evaluation, as they provide a worldwide framework for consistent and clear monetary reporting. Here are some frequently requested questions and solutions about accruals and deferrals. When the bill is paid, the entry is modified by deducting $10,000 from cash and crediting $10,000 from accounts receivable. You would report the transaction by debiting accounts receivable and crediting revenue by $10,000. If items are acquired or a service is used, it goes on the books right away, even if payment comes later.

How Does A Receipt Scanner Relate To Accrual And Deferral Accounting?

Auditors assess the reasonableness of accruals by evaluating the assumptions and estimates underlying them. They search for evidence that supports the deferral or recognition of revenues and bills, guaranteeing that the accruals reflect the financial reality of the company’s operations. Prepaying insurance, for example, is usually recorded on the stability sheet as a current asset, with the expense postponed.

What Are The Variances Between Accrual And Deferral Accounting Methods?

As a result of this money advance, a legal responsibility referred to as “Projects Paid in Advance” was created and its present balance is $500,000. Every company has its own insurance policies and procedures regarding the use of accruals and deferrals as part of their accounting process and these function the framework for its accountants in relation to reporting. An accrual system acknowledges revenue within the earnings statement earlier than it’s received. A deferral system goals to decrease the debit account and credit score the revenue account.

- Deferral accounting, on the other hand, does not require such changes since revenue and expenses are acknowledged primarily based on cash actions.

- Each methods—accrual and deferral—change how an revenue statement looks as a end result of they determine when to record revenues and expenses.

- This ensures that your financial statements replicate all relevant bills, providing a clearer image of your company’s financial health.

- Accrual accounting and deferral accounting are two elementary strategies utilized in monetary reporting, each with distinct implications for recognizing income and expenses.

- Deferred revenue, or unearned income, represents cash obtained in advance for goods or companies not yet delivered, whereas prepaid expenses, such as insurance coverage or rent, are recorded as property until they’re incurred.

- For instance, accrued income encompasses services offered however not but invoiced, while accrued expenses embody costs incurred however not but paid, like utilities or wages.

Accrual accounting and deferral accounting are two basic methods utilized in monetary reporting, every with distinct implications for recognizing income and expenses. Accrual accounting records income and expenses when they are earned or incurred, irrespective of cash actions. This ensures that financial statements precisely reflect the monetary performance and place of a enterprise over a specific period, adhering to the matching precept. For occasion, accrued revenue encompasses companies offered but not but invoiced, whereas accrued expenses embody costs incurred but not but paid, like utilities or wages.

For example, if an organization receives a large order on the finish of a financial period, accrual accounting would report this revenue instantly, offering a more correct illustration of the period’s results. For instance, you may pay for property insurance coverage for the coming 12 months earlier than the policy goes into impact. Throughout each accounting period, you would recognize the fee as a present asset and debit the account as an expense. Every method – whether accrual or deferral – plays an enormous role in following rules just like the matching principle in accounting. This principle says businesses ought to match expense recognition with associated revenues in the identical interval, serving to to avoid deceptive monetary reporting.

Right Here are a few of the key variations between accrual and deferral strategies of accounting. For example, if the corporate prepares its financial statements within the fourth month after the lease is paid upfront, the corporate will report a deferred expense of $8,000 ($12,000 – ($1,000 x 4)). Similarly, the hire expense within the income assertion shall be equal to $4,000 ($1,000 x 4) for under four months.

This ensures that your monetary statements mirror all related bills, offering a clearer image of your company’s financial health. Imagine the thrill of recognizing income through accruals, permitting you to actually really feel the financial success of your corporation. Accruals play a vital position in precisely reflecting your company’s monetary health by matching revenues with expenses in the same accounting interval. Understanding the nuances between accruals and deferrals is important for anyone navigating the complexities of advanced accounting.

We break down accruals vs. deferrals, tips on how to report each type, and why they matter for correct reporting, investor confidence, and smarter monetary planning. For instance, you’re liable to pay for the electricity you utilized in December, however you won’t receive the bill till January. You would recognize the expense in December after which when cost is made in January, you’d credit score the account as an accrued expense payable. So, what’s the difference between the accrual method and the deferral method in accounting? Let’s explore each methods, walk via some examples, and look at the important thing differences.